CYBER INSURANCE AND MFA

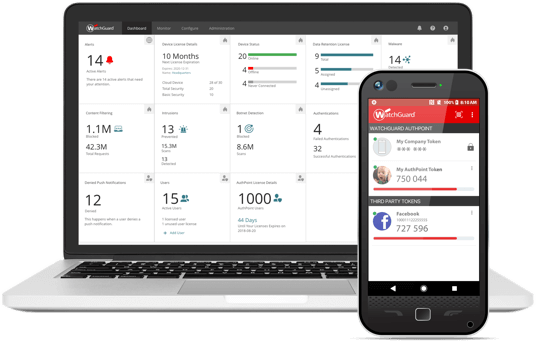

Protect your sensitive data with Multi-Factor Authentication (MFA)Are you looking to purchase a cyber liability insurance policy? If yes, insurers are advising organisations to adopt Multi-Factor Authentication before taking out a cyber insurance policy to limit the potential damage caused by cyber attacks to your business.

Protecting sensitive data with multi-factor authentication (MFA) has become a requirement for many cyber insurance policies.

If you want to eliminate your company’s number 1 risk by quickly and easily closing security gaps that leave your company vulnerable to a breach, contact our team today to arrange a training session and a FREE 30-day trial for up to 250 users!

Why are cyber insurers requiring multi-factor authentication?

80% of data breaches involve the use of weak passwords or stolen credentials . Identity-focused security controls are no longer optional and insurance companies know that. Underwriters are requiring policy holders to implement MFA to reduce the risk of pay-outs on policies and ensure their profitability.

12021 Verizon Data breach Incident Report

The cost of an attack vs. the cost of a policy

A malware attack can cost millions while the typical cost of cyber liability insurance is a small fraction of that , but only if you have the right protection in place to begin with. In a world where access is based on user identity, any additional layer of security pays off.

2Techrepublic.com

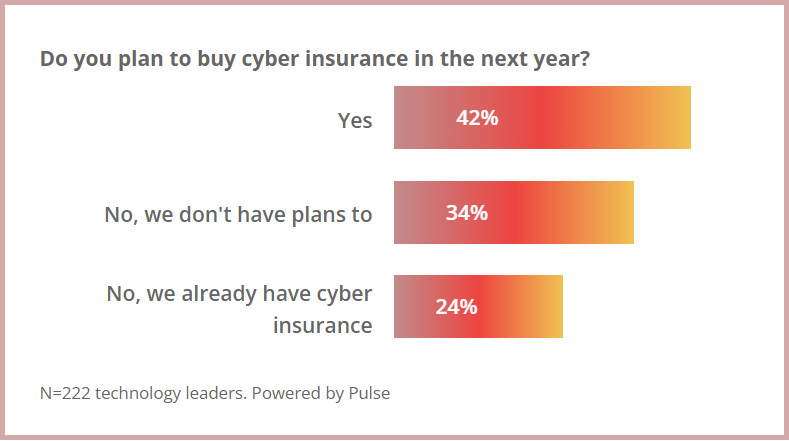

Check out a recent survey carried on behalf of WatchGuard that provides us with an insight into organisations’ attitude to cyber insurance. As remote access becomes a top priority for more and more people, workplaces are either already paying for cyber insurance or planning to buy it. If you don’t have it, you will soon need it.

If you want to eliminate your company’s number 1 risk by quickly and easily closing security gaps that leave your company vulnerable to a breach, contact our team today to arrange a training session and a FREE 30-day trial for up to 250 users!

WatchGuard AuthPoint MFA protects these areas so that you can qualify for Cyber Insurance

Email access for all employees

Admin access to network infrastructure (routers, firewalls, etc.) including internal users and service providers

Remote/VPN access for employees, contractors, and service providers

Admin access to endpoints and servers including internal users and service providers

Multi-Factor Authentication Webinar

Learn more about MFA requirements from insurance companies and the demand for:

- Easy-to-use authentication

- Remote and VPN access protection

- Optimised productivity with web single sign-on access

- Risk-based authentication

- Low cost and adaptable for business needs

If you want to eliminate your company’s number 1 risk by quickly and easily closing security gaps that leave your company vulnerable to a breach, contact our team today to arrange a training session and a FREE 30-day trial for up to 250 users!

MFA Case Studies

Check out some AuthPoint MFA Success Stories and their experience of the AuthPoint MFA support, usability and features.

MedNet uses AuthPoint to keep patient records safe and sound in the hands of authorised employees.

Fletchers law firm deployed AuthPoint to prevent a breach and protect their clients’ data.

Ellips uses AuthPoint for traveling employees to prevent unauthorised access to lost or stolen devices.

If you want to eliminate your company’s number 1 risk by quickly and easily closing security gaps that leave your company vulnerable to a breach, contact our team today to arrange a training session and a FREE 30-day trial for up to 250 users!